We believe that the 3rd Reconstruction is about Opportunity.

Powering a 3rd Reconstruction vision, Operation HOPE has implemented a 10-year strategy to raise the economic energy and economic oportunity for the bottom 50% of American society, led by the growing HOPE Inside Network. There are over 200 on the ground HOPE Inside locations in most American states today.

Financial Literacy for All Initiative, the new HOPE Community Credit Index and the growing HOPE Inside Network.

We recently opened our 200th HOPE Inside location with Wells Fargo in DeKalb County, Ga. The HOPE Inside Network is ‘America’s financial coach.’

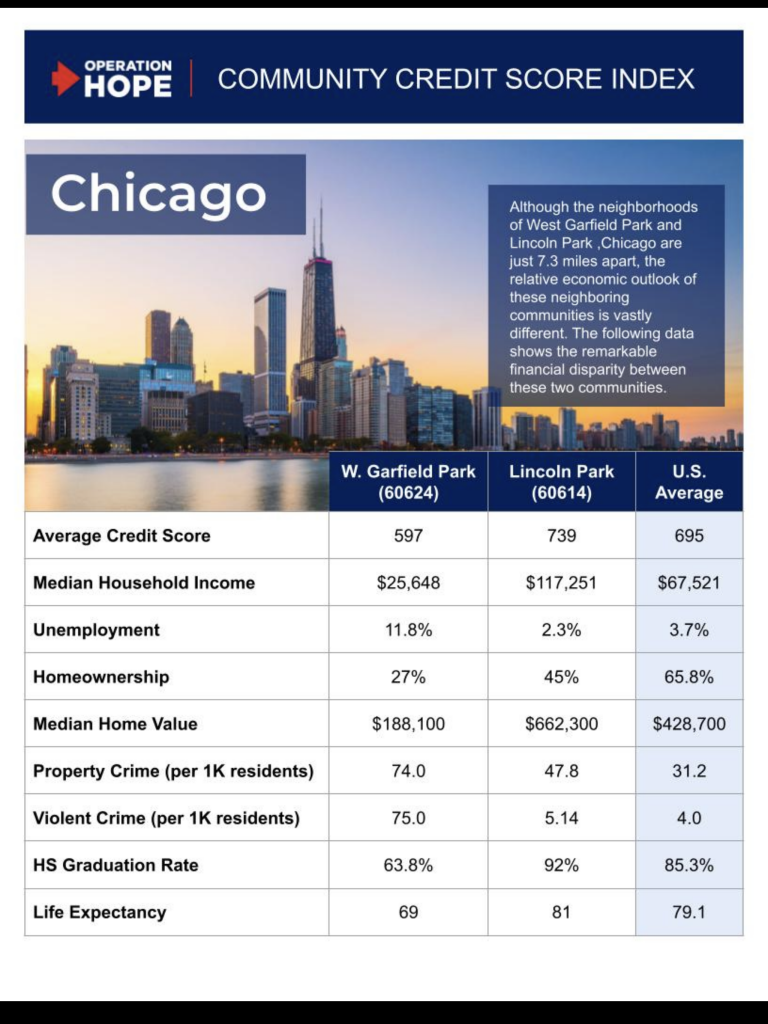

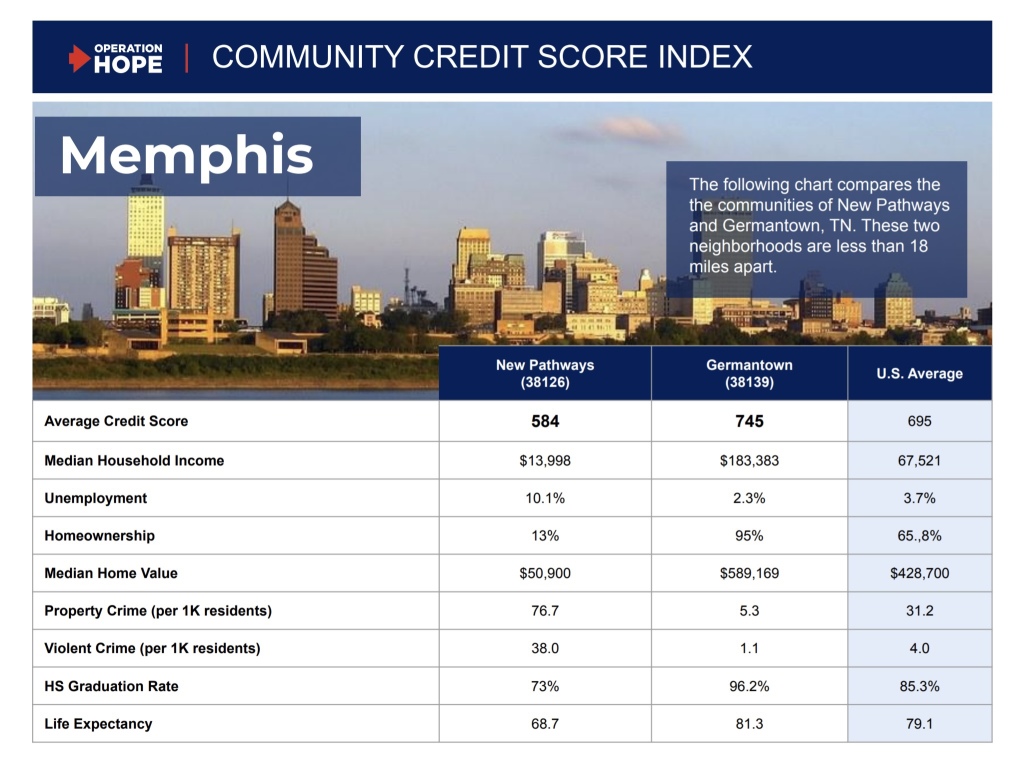

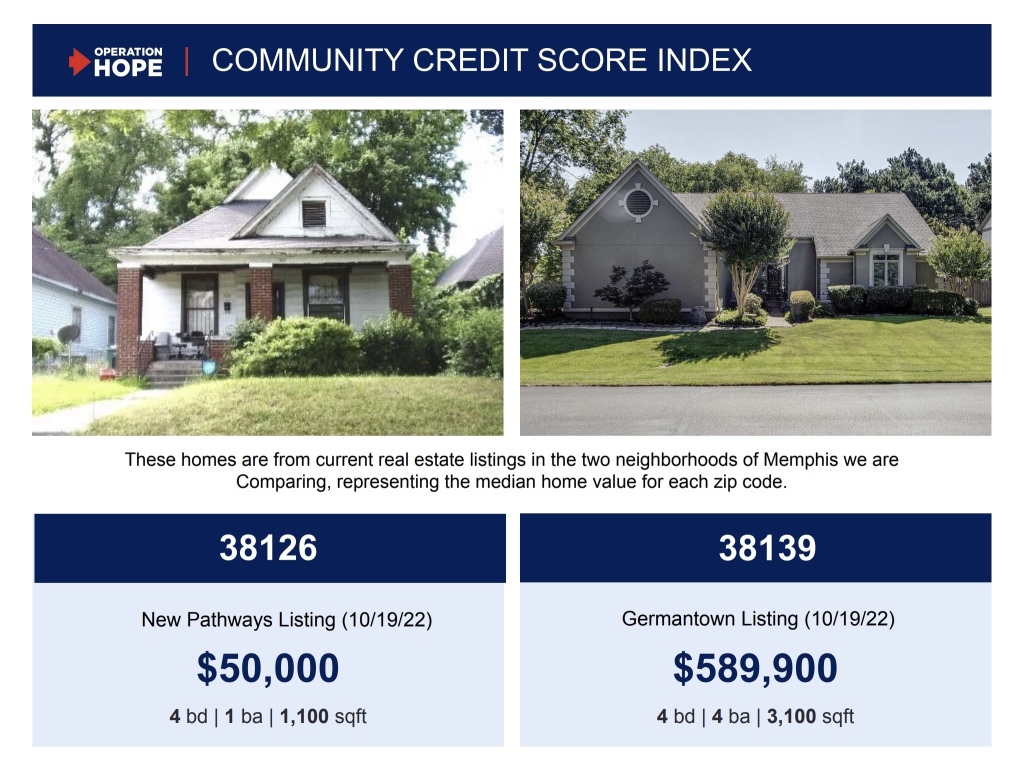

And then we stood up a first ever HOPE Community Credit Score Index, powered by Experian and their national data, which is a powerful, data driven national to local framework to measure everything, down to the level of the zip code. Here is a link to our original announcement.

And we also stood up the Financial Literacy for All Initiative, co-chaired by Doug McMillon, CEO of Walmart and myself, to embed financial literacy into the culture and ‘business plan’ of America, and American business.

Currently Financial Literacy for All includes more than 50 of America’s leading Fortune 200 brands, and its growing.

The 400 Year Old African-American Journey

Reflecting on my own African-American community, and where we sit currently around financial readiness and economic opportunity for all — I have come to the conclusion that while we have all the required intelligence, the work ethic, and the enterprise to build real wealth, and to lead in business, these attributes alone are not enough.

As I outlined in my bestselling book The Memo, while the African American community tend to be amongst the most hard working and aspirational in America, because either we were outright denied liberty, or simply because no one bothered to teach us how this credit, capital access, business and capitalist system works (i.e. the failure of the Freedman’s Bank in 1865), African-Americans have been largely left out of the American wealth building system. We know how to make money, but no one bothered to each us how to build wealth. No one taught us basic financial literacy.

As a result, today I believe that approximately half of African-Americans are locked out of the free enterprise system, and with that, locked out of mainstream access to credit and capital

About 54% of Black Americans report having no credit or a poor to fair credit score, which is considered to be any score below 640, according to a recent survey of 5,000 U.S. adults by Credit Sesame. About 41% of Hispanic Americans report falling into this category as well. Source: CNBC. Jan 28, 2021

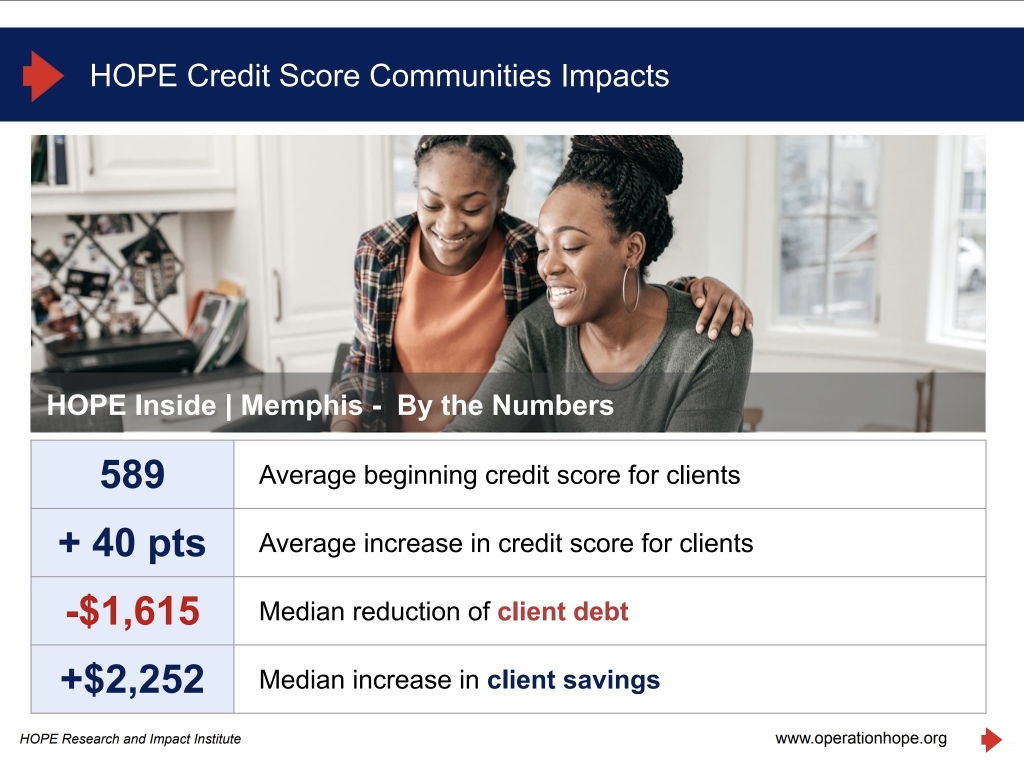

Taken on its face, the data suggests that African-Americans have (1) the lowest overall credit scores in America by race, (2) the highest percentage by race below the 620 credit score threshhold (a baseline for basic mainstream access of credit and capital), and as a result, not surprisingly, (3) we have the highest decline rate for credit borrowings. it impacts everything. Let’s look at Memphis data, as but one example.

And here is yet another shocking data point that we found when looking at African American communities with low credit scores (below 600 or so); we tend to live about 20 years shorter lives (61 years old on average vs 81 years or more), if we live in a low credit score zip code.

That means we pay into the Social Security System our entire lives, and yet most of us will never even use or see the benefits of it in our golden years. In underserved areas, we tend to die on, average, well before the 65 year old utilization period for Social Security.

Moreover, the neighborhoods with the highest correlations of crime, low education levels, high unemployment levels, low levels of small business creation, one parent families, etc — are sub-600 credit score communities; be they poor black and brown urban, or white and poor rural. We believe that we have finally cracked the code, on how to put struggling communities back together, and on a road to sustained prosperity for all.

And so yes, we have to update and refine the banking and financial system, and deal with racism and biases, but we also need to teach people the rules of the game, at scale. We need a civil rights agenda, and a silver rights agenda also.

The good news here is, the proven work of Operation HOPE are also moving these important Index numbers in the right direction in and for our communities; increasing credit scores 50 points or more, reducing debt by more than $2600.00, and increasing savings by $400 or more, within the first year for someone making about $48,000. That’s game changing for their lives, and for a city. We are literally helping to create ‘contributing citizenship,’ on a sustainable basis.

We are making the case, for a new emerging market American story. One written by us, for us, benefiting us all. Operation HOPE will do its part, but we need all of your support as we do.

With HOPE

John Hope Bryant, founder, Operation HOPE