We recently opened our 200th HOPE Inside location with Wells Fargo in DeKalb County, Ga. The HOPE Inside Network is ‘America’s financial coach’ and the nation’s private banker for the underserved. The CEO of Wells Fargo joined us for the opening and the bank has ordered 120+ additional locations, as has Bank of America (not yet announced), US Bank, and countless others. Truist Bank has committed that more than half of their branches will become HOPE Inside associated. We are also the HOPE Inside the Workplace partner for Delta Airlines employees nationwide, and UPS.

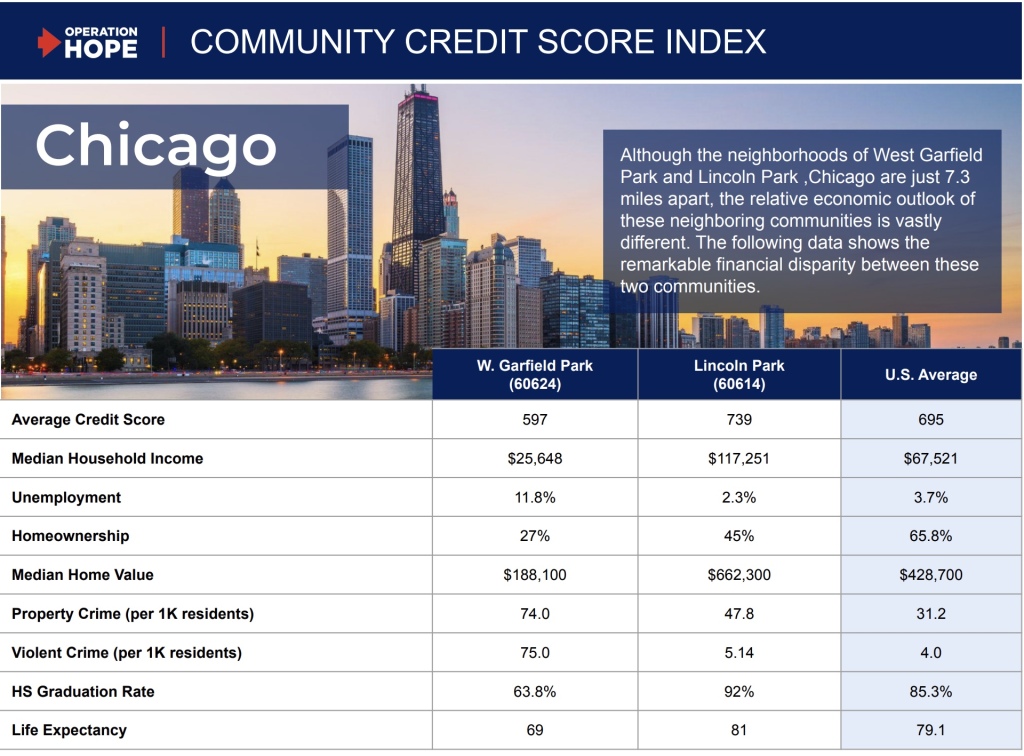

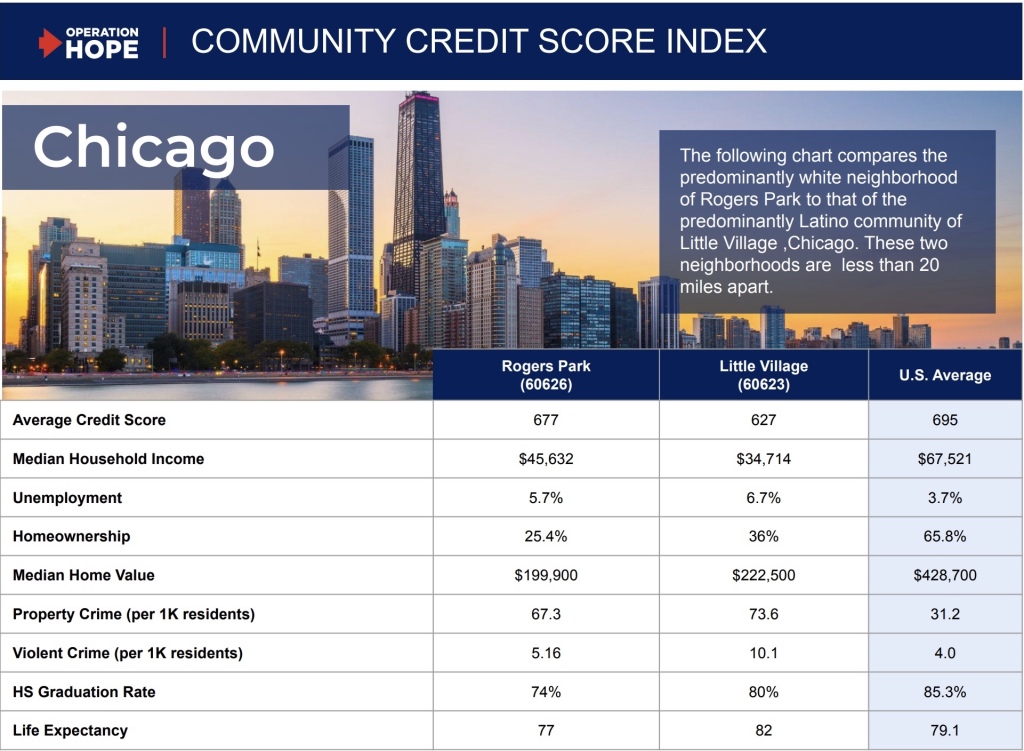

In 2022 we stood up a first-ever HOPE Community Credit Score Index, powered by Experian and their national data, which is a powerful, data-driven national-to-local framework to measure everything — down to the zip code level. Here is a link to our original announcement. The data is game changing. We can now measure community health, block-by-block, with financial metrics.

As but one example, while the African American community tends to be amongst the most hard-working and aspirational in America, because either we were outright denied liberty, or simply because no one bothered to teach us how this credit, access to capital, business, wealth creation and capitalist system works (i.e. the failure of the Freedman’s Bank in 1865), African-Americans (1) have today the lowest overall credit scores in America by race, (2) the highest percentage of any group below 620 credit score (as baseline for basic mainstream access of credit and capital), and thus, not surprisingly, (3) the highest declination rates for all mainstream credit borrowers. And so yes, we have to update and refine the banking and financial system, but we also need to teach people the rules of the game, at scale.

When the Emancipation Proclamation was signed in 1863, the Black community owned a total of 0.5 percent of the total wealth of the United States. … More than 150 years later, that number has barely budged–-Blacks still own only about 1 percent of wealth in the United States.

And here is yet another shocking data point that we discovered when looking at African-American communities with low credit scores — we tend to live about 20 years shorter lives (61 years old on average vs. 81 years or more in high credit score neighborhoods). That means we pay into the Social Security System our entire lives, and yet most of us will never be able to use the benefit.

Moreover, the neighborhoods with the highest correlations of crime, low education levels, high unemployment levels, low levels of small business creation, one-parent families, etc — are sub-600 credit score communities; be they poor black and brown urban, or white and poor rural. We believe that we have finally cracked the code on how to put struggling communities back together and on a road to sustained prosperity for all.

Two zip codes in Chicago tell a powerful story through our HOPE Index data, of the stark differences in America. These two rich and poor neighborhoods are about a 12-minute drive from each other, but could not be more strikingly different.

The good news is the proven work of Operation HOPE is also moving these important Index numbers in the right direction in, and for, our communities; increasing credit scores 50 points or more, reducing debt by more than $2600.00, and increasing savings by $400 or more, within the first year for someone making about $48,000. That’s game changing for their lives, and for a city. We are literally creating ‘contributing citizenship,’ on a sustainable basis.

On the leadership front we stood up the Financial Literacy for All Initiative, now co-chaired by Doug McMillon, CEO of Walmart and myself, to embed financial literacy into the culture and ‘business plan’ of America, and American business. More than 50 Fortune 200 companies are already committed in less than a year, along with the Commissioners of the NFL and NBA.

Finally, we have spearheaded a 10-year initiative to create one million new black businesses in America, by 2030. It’s called 1MBB, and is backed by a $130 million commitment from Shopify. We just signed a national agreement with the U.S. Small Business Administration to power 1MBB.

And we have done all of this while maintaining the highest level of financial integrity of and for the organization, including a very rare 4 Star Charity Navigator Rating (the highest possible), with only 7% of all nonprofit organizations in the country achieving this prestigious rating consecutively. Close to 90 cents or every dollar goes to empower underserved communities and individuals.

Operation HOPE will become America’s financial coach, and the private banker for the underserved nationwide, both urban and rural, with a goal of having 1,000 HOPE Inside locations by 2025, and unleashing untapped human capital potential at scale. For the benefit of all.

John Hope Bryant, founder, Operation HOPE