Earlier this week I had the privilege of joining Treasury Secretary Janet Yellen at a meeting of the Financial Literacy and Education Commission to discuss how the lack of financial literacy is impacting Americans, especially those in predominantly Black and brown communities.

I, along with a select number of peers and colleagues who are working towards the same goals in different lanes, had an opportunity to explain how a lack of financial literacy and empowerment is impacting the communities of color and is a critical blocker in the sustainable creation of wealth and a path towards a meaningful solution.

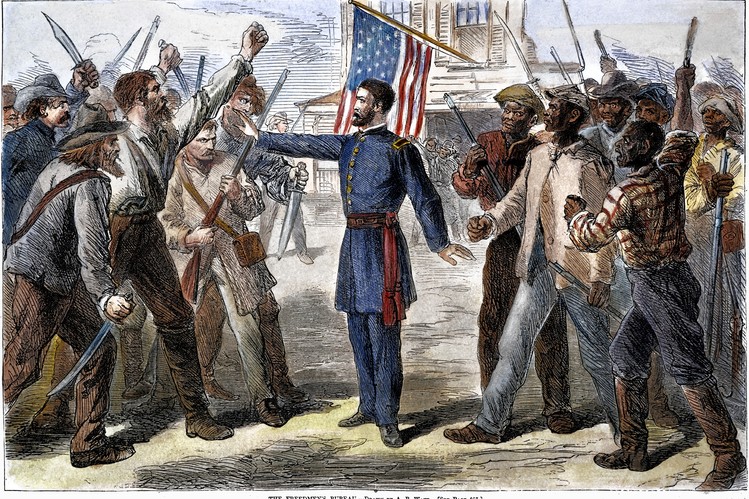

This problem is not new. It has been a critical issue since the institution of slavery. Even with its abolition, Black Americans were denied any sort of long-term, significant assistance in learning about and participating in the American economic system in a meaningful way. Despite the resiliency of a community, the embedded and systemic racism perpetuated against people of color through the destructive policies of Jim Crow have impeded any type of meaningful widespread wealth development which has led to a series of other social and economic problems.

As I explained during my address to the Commission, these unaddressed issues persist today. Yes, significant progress has been made over the years, reaching critical inflection points each century, but each time the policies fall short of meeting their goals. We have arrived at a Third Reconstruction for America, and I believe that this Reconstruction has the power to change the trajectory of Black America and our nation forever.

The coronavirus pandemic has unearthed and uncovered a massive financial literacy problem in our country. It’s not that it wasn’t already there. Simply, the tools we used to create the facade ran out. I often say that when white America has a cold Black America has the flu, and the sentiment applies here as well. At the onset of the pandemic, Black Americans were the first to be let go from their jobs and economist say that they will likely be the last to be rehired in the bounce back of the economy. We are in critical need of a solution and a salve to this enduring problem. Financial literacy alone is not the answer, but it is a major component of a long-term solution.

To address this growing need for financial literacy and wealth creation, Operation HOPE has launched two massive initiatives which can help turn the tide on financial education and opportunity: 1 Million Black Businesses and Financial Literacy for All. With both, we are working with a number of CEOs and organizations to increase our reach and accelerate the empowerment of communities across America. With 1MBB, we have committed to standing up 1 million Black-owned businesses over the next decade, with a $130 million commitment from our lead organizational partner, Shopify. With Financial Literacy for All, we have partnered with the CEOs of Walmart, Disney, Delta Air Lines, Walgreens, Khan Academy, and others to reach 5 million employees with financial literacy to help them take control of their financial lives.

This is one of the major civil rights issues of our time and we must address it now.

I was pleased to hear that Secretary Yellen holds these issues near to her heart and is committed to ensuring progress in this area at this pivotal time as her predecessors did before her in times of great change.

We have corporate America’s attention and we have the federal government’s attention. If we continue to raise awareness and create a coalition of the willing, we will continue to see change and progress in our nation for years to come.

You can watch the full meeting here. If you’d like to get involved in our work, feel free to leave a message in the comments below and we’ll find a way to partner with one another in meaningful ways.