This week, Operation HOPE released our Q1 2025 HOPE Insider Report, and the results speak volumes—not just about the economy, but about the mindset of everyday Americans trying to navigate it.

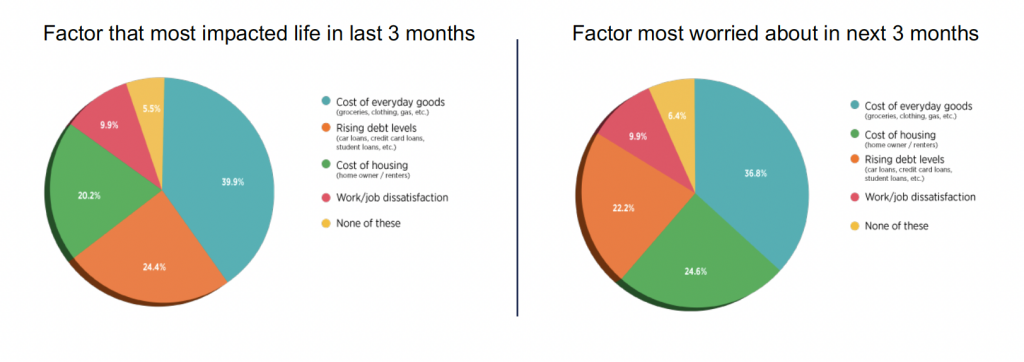

Let’s be honest: people are worried. Nearly three out of four respondents aren’t confident in the stability of the U.S. economy right now. Paycheck-to-paycheck living is still the norm for most families, and costs for food, rent, gas, and basic necessities continue to climb. Debt is rising, especially credit card debt, and job satisfaction is sliding. People are feeling the pressure.

But here’s the part that hit me—and reminded me why we do this work:

80% of the people we surveyed still believe their personal finances will improve this year.

That’s hope.

And it’s not blind optimism—it’s earned hope. Hope rooted in action. In the first quarter of 2025 alone, clients working with Operation HOPE saw an average 39-point increase in credit scores, a $1,893 decrease in debt, and more than $1,100 in new savings.

When you empower people with tools, coaching, and dignity, they rise.

When you give them a plan—not just pity—they build wealth.

The economy might be uncertain, but our mission is not. We’re going to keep meeting people where they are, coaching them forward, and turning anxiety into action. Because no matter what’s happening in Washington or Wall Street, financial literacy and economic opportunity remain the most powerful tools of freedom we’ve got.

Read the full report, share it with someone who needs to see it—and most of all, let’s keep pushing this radical movement of common sense forward.