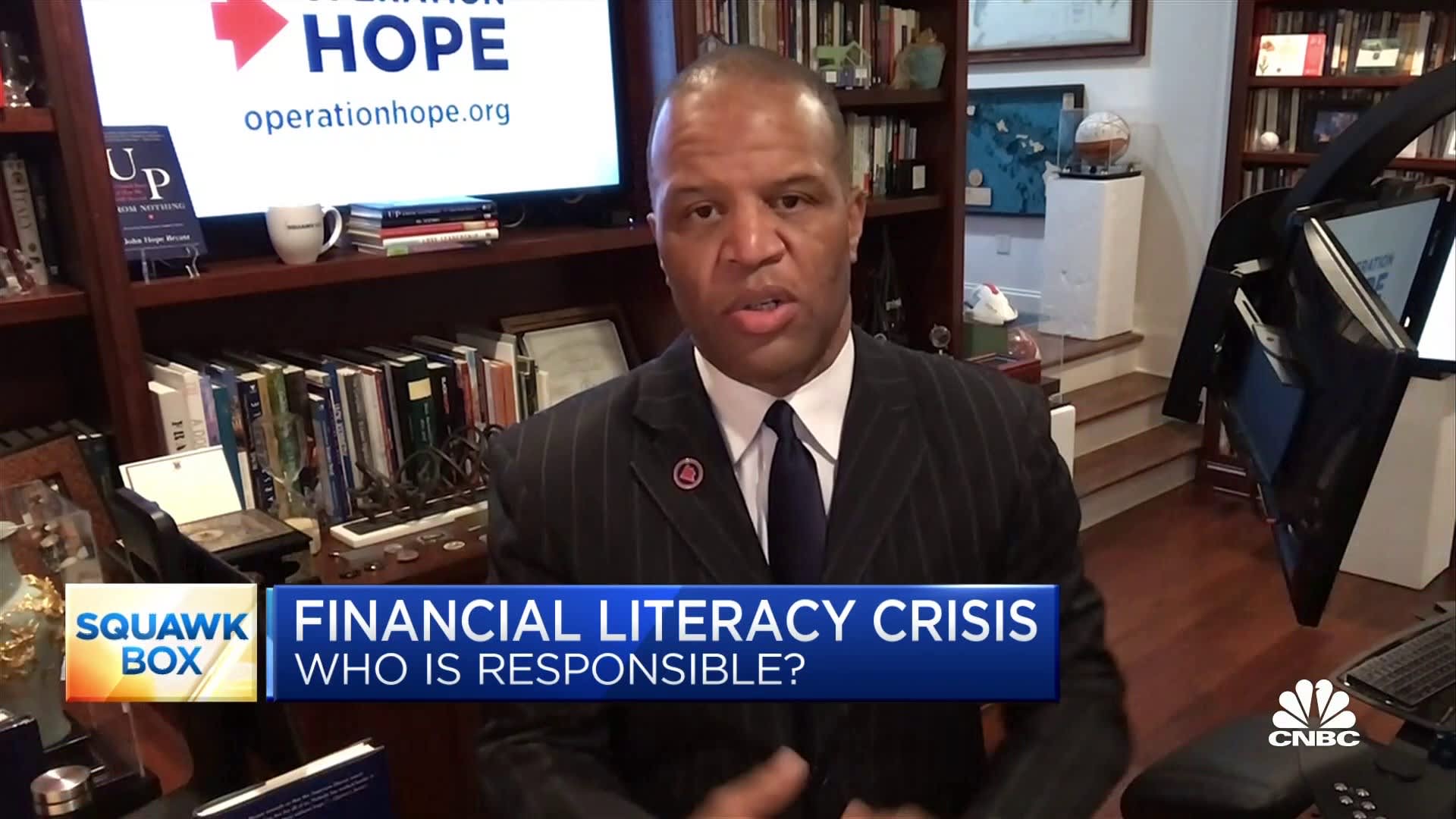

I appeared on CNBC SquawkBox on yesterday morning and Anchor Becky Quick and I briefly ran through our recommendations for the self-policing of Wall Street, on the topic of investor education for all (similar to our decades long engagement and reforms in the FDIC insured banking sector, with regard to financial literacy education, for Main Street).

We call it the Operation HOPE Investor’s Bill of Rights, and my team subsequently detailed it and publicly released it yesterday afternoon. Please read the below and share broadly. We will soon be making direct contact with industry leaders.

ATLANTA–(BUSINESS WIRE)–Operation HOPE, a leading non-profit focused on financial literacy and empowerment, today announced its Investors’ Bill of Rights to address the greater need for individual investor protections. The recent “meme stock” trading phenomenon and the ongoing growth of individual investor use of commission-free, mobile brokerage apps to access U.S. capital markets has prompted Operation HOPE to focus its resources and platform to call for financial institutions and brokerage companies to provide greater financial literacy, knowledge and understanding to its customers.

“We are calling on both the financial services industry and regulators to embrace reforms so that the stock market remains a safe and secure market for capital and wealth formation accessible for all, rather than an insiders’ game or risky gambling operation.”

Tweet this

Operation HOPE Founder, Chairman and Chief Executive Officer John Hope Bryant outlined the need for the Investors’ Bill of Rights on this morning’s broadcast of Squawk Box on CNBC. The 10-point Bill of Rights is based on more than 20 years of experience that Operation HOPE has garnered through providing free financial literacy coaching and credit counseling services to more than 4 million individuals and small businesses.

“Education, fairness and equal access for all market participants is a focus of Operation HOPE, and the events of the past two weeks with wild fluctuations of a couple of stocks within the equities market shows that reforms are needed now to protect the individual investor, especially those that are new to stock investing,” said Mr. Bryant. “We are calling on both the financial services industry and regulators to embrace reforms so that the stock market remains a safe and secure market for capital and wealth formation accessible for all, rather than an insiders’ game or risky gambling operation.”

The Operation HOPE Investors’ Bill of Rights are:

- Financial institutions shall provide comprehensive investor education programming and investment coaching at no cost to the consumer.

- Individual investors shall become qualified by passing a Basic Knowledge exam – an investor’s driver’s license – to qualify as an “accredited” investor by demonstrating an understanding of the risks and rules of investing.

- Financial institutions shall provide financial literacy and investment fundamentals resources for all individual account holders by accredited third-party investment education coaching/seminars through its communications channels. Provisions include a “pause” while an individual is in transaction mode—by embedding a cautionary checklist before consummating a trade developed and manned by a third-party and paid for by the platform being used.

- Financial institutions shall provide enhanced transparency by requiring all parties involved in the process of trading in any capacity to disclose any investment or interests.

- True costs of transactions shall be disclosed, ending the practice of payments for order flows thereby ensuring equal access to markets for individuals as well as institutions.

- Financial institutions shall develop a reward system for consumers who increase their financial literacy and investment fundamentals knowledge base, including discounted costs and other monetary incentives.

- Investment participants shall clearly and completely disclose both short- and long-term holdings and/or advocacy positions taken by professional investors of third-party capital managers and their employees.

- All management meetings with large shareholders shall be publicly disclosed in a timely manner.

- Public reporting of customer utilization of financial literacy and investor education shall be highlighted on company websites, part of their quarterly reporting, as well as in federal and regulatory filings.

- Investor education shall be a core element in a financial institution’s business model in order to be included in the market’s evaluation of a company.

For more information about the Operation HOPE Investors’ Bill of Rights, please contact Kevin Boucher at 213-479-7833 or kevin.boucher@operationhope.org.

About Operation HOPE, Inc.

Operation HOPE is America’s leading nonprofit financial inclusion organization for the underserved, and “America’s Financial Coach for All”. Since 1992, Operation HOPE has been moving America from civil rights to “silver rights” with the mission of making free enterprise and capitalism work for the underserved—disrupting poverty for millions of low and moderate-income youth and adults across the nation. Operation HOPE pioneered financial literacy in the banking sector, and inspired President George W. Bush to make financial literacy the policy of the U.S. Federal Government.

Through our community uplift model, HOPE Inside, which received the 2016 Innovator of the Year recognition by American Banker magazine, Operation HOPE has served more than 4 million individuals and directed more than $3.2 billion in economic activity into disenfranchised communities—turning check-cashing customers into banking customers, renters into homeowners, small business dreamers into small business owners, minimum wage workers into living wage consumers, and uncertain disaster victims into financially empowered disaster survivors.

Our programmatic approach to expanding opportunity for all aims to improve financial literacy, increase business role models and business internships for youth in underserved communities, and stabilize the American dream by boosting FICO scores. Operation HOPE recently received its seventh consecutive 4-star charity rating for fiscal management and commitment to transparency and accountability by the prestigious non-profit evaluator, Charity Navigator. For more information: www.OperationHOPE.org. Follow the HOPE conversation on Twitter, Facebook and Instagram.