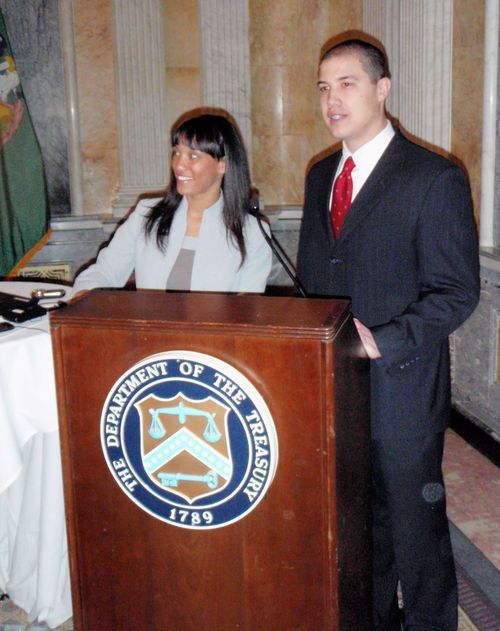

The US Department of the Treasury – Financial Literacy and Education Commission (FLEC) held their first quarter 2011 meeting to continue their work toward improving financial literacy and leveraging resources across 22 Federal Agencies on January 26, 2011. Based on the most recent activity and update around the Gallup-Operation HOPE Financial Literacy Index (GOHFLI), both Gallup and Operation HOPE were invited to present the findings and the innovation related to the findings. With a crowd of over 100 people (largely comprised of federal agency representatives and persons of influence in financial literacy and education) in the US Treasury Cash Room, Jason Milton of Gallup, Inc. presented the scientific findings and Jennifer Thibeaux of Operation HOPE presented the next steps innovation model designed to maximize intervention impact in schools.

The science of the Index is that it is an instrument that offers the first measurement that provides the meaning structure of money and the future from a youth perspective. The instrument was developed to correlate measures of hope, wellbeing, and engagement with financial literacy. In conjunction with the administration of the Gallup Student Poll, 10 additional questions were added that specifically addressed financial matters. Here’s what we found from the first administration of the Index:

· Methodology: Convenience Sample of approximately 70,000 students grades 5 – 12 across the US took the GOHFLI portion of the survey

· Results:

o Financially Literate – 39%

o Financially Aware – 24%

o Financially Illiterate – 37%

· Social Scientific Conclusions

· There is a relationship between hope, engagement, and wellbeing and financial literacy as measured by the GOHFLI.

o 56% of hopeful students qualify as financially literate; whereas 13% of discouraged students qualify.

o 53% of engaged students qualify as financially literate; whereas 13% of actively disengaged students qualify.

o 47% of thriving students qualify as financially literate; whereas 11% of suffering students qualify.

· 70% of students who indicated they have a bank account qualify as financially literate.

With the GOHFLI, Gallup and Operation HOPE provide an important measure to inform educators, parents, and policymakers about how to prepare our kids and our nation for a prosperous and thriving future.

Jennifer Thibeaux presented the innovation model that will be used to address GOHFLI findings. Influenced by Gilbert’s Behavioral Engineering Model and the Theory of Transformative Learning, Operation HOPE will implement a systematic approach to interventions to include involvement from the individual student, school administration, political support, and corporate sponsors to solve to knowledge, ability/accessibility, and motivation.

This model was met with high interest and many federal agencies were interested in hearing more in the near future. “It will take a team approach to thinking about, addressing, and transforming the economic behavior of youth”, Jennifer said. “This meeting is a by-product of the ‘team’ realizing that we must work together, leverage resources, and create a common goal in order to transform lives.” With the help of the Department of Education among other federal agencies, both Gallup and Operation HOPE are excited about institutionalizing the concepts of financial literacy during the formative years of education to become the difference-maker for our economic future.

Jennifer Thibeaux, Ph.D.(abd), SPHR

Director

Office of Innovation, Research, & Assessment

Operation HOPE, Inc.